Does Your Accounting System Make the Grade?

Your accounting system can make or break a finance department’s strategic impact on your company’s growth. If you find yourself having to put in hours of manual work, lacking insight into your business, and an inability to grow your company because of your accounting system it is time to consider if it’s making the grade. Read through our list of what your accounting solution should provide.

What You Should be Looking For in Your Current and Future System:

- Accurate Bookkeeping- Overall an accounting solution allows businesses to keep track of financial transactions. This includes being able to create income statements, balance sheets, cash-flow statements, and custom reports all without human error. Being able to eliminate errors ensures that decisions for expansion are made on accurate information.

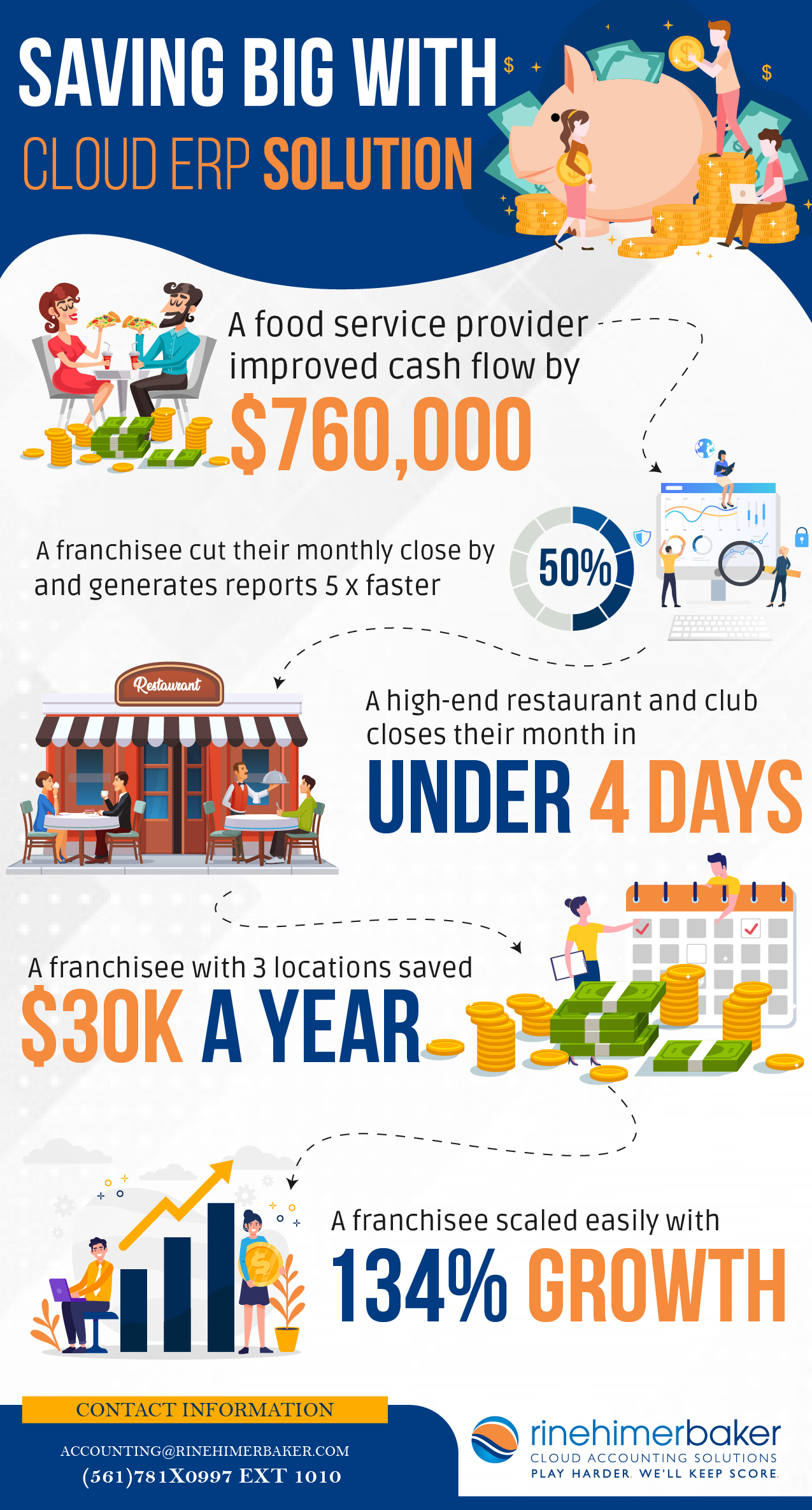

- Scalability- The accounting system your company uses should have the ability to grow as sales increase. As your business expands through new locations, product lines, expansion into new countries, or additional customers your system should be able to easily add these into its system. Look at your current system if you added a new location to your company how long will it take for your accounting solution to add it? Hours or days? Is there a cap on how many can be added in total or is it unlimited? How easy is it to add a finance employee to your system? If your system is limited in its capabilities to expand then it’s not making the grade.

- Ease of Use- Having a system that is user-friendly is key to maximizing the insight a finance department can produce quickly. This also allows you to focus on potential employees’ capabilities from a strategic point of view vs. their pre-knowledge of how to use your accounting system.

- Audit Features- An audit can be an intimidating part of the year if your finances aren’t organized. An accounting system that allows you to add notes to any manual changes that are made as well as a drill-down ability makes it easy to get by with flying colors.

- Cloud-Based/ Web-Hosted- In the current technology impacted times not being able to access your financial data anywhere anytime will instantly put you behind your competition. Does your current system allow you to have team members spread out across the country? Can you log in at any point in time to access a report?

- Time Saving Automation- When companies implement new technology one of the biggest benefits they are looking to achieve is time savings. Your accounting system should be working for you. Reports should be instantly produced based on settings that have been saved. Your system should also have the ability to seamlessly integrate with your other software solutions such as your CRM. If your business changes how long does it take to get a new report from accounting?

Does your current accounting system do all of the above? Does it make the grade?

Find out how rinehimerbaker can help your company get results through the cloud by reaching out to accounting@rinehimerbaker.com.